Seated for Success

Well-curated boards can be strategic multipliers

In high-altitude governance, even the most capable leadership teams can lose their way without the right guides. A well-composed board acts as your corporate sherpa, equipped with specialized expertise, foresight to navigate treacherous terrain, and the discipline to keep your organisation ascending when others plateau.

Time spent on architecting the right board composition is like sharpening your sword in preparation for battle.

But the reality is that private equity-funded companies must simultaneously build a business and appoint a board from scratch. So, they tend to postpone board appointments. Or worse, appoint in haste.

In over five decades of enabling leadership fitments for Indian companies, one truth has emerged with striking clarity: a well-curated board of directors can be a strategic multiplier.

Leading governance research indicates that boards with directors whose expertise aligns with the company’s strategic challenges contribute significantly more to company performance.

Crafting Boards That Help You Win: Three Timeless Principles

To build a board that functions as a strategic multiplier requires a systematic approach grounded in three fundamental principles, heavily sprinkled with human judgment.

1. Align Board Composition with Strategic Priorities

Effective boards are reverse engineered from the company’s strategic imperatives. This means identifying the most critical challenges and opportunities facing the business, then recruiting directors whose expertise directly addresses these areas.

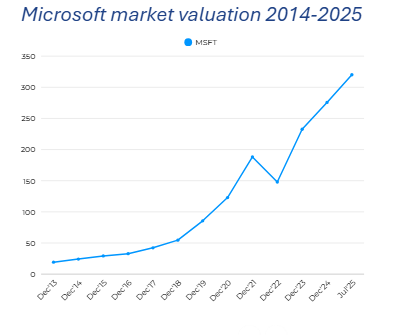

In 2014, Microsoft faced a pivotal challenge: transitioning from a legacy software-centric model to a cloud-first, AI-driven future under CEO Satya Nadella. The board recognised that its composition, heavy with traditional tech and finance expertise, needed reinvention to guide this transformation.

They identified two critical gaps:

- Lack of deep cloud computing and enterprise transformation expertise at the board level.

- Need for directors with experience scaling subscription-based models (vs. one-time software sales).

They systematically added strategic competencies and experiences that helped them scale the next bigger mountain:

- John W. Thompson (Chairman, 2014–2021): Former Symantec CEO with cybersecurity/cloud acumen. Steered Microsoft’s shift to enterprise services.

- Charles H. Noski (2014): Former Bank of America CFO, added financial rigor for recurring revenue models.

- Padmasree Warrior (2015): Ex-Cisco CTO, brought IoT and edge computing credibility.

Result:

- Microsoft’s commercial cloud revenue grew from $6.7B (2015) to $110B+ (2023).

Azure became the backbone of AI partnerships (OpenAI, Nuance) under board oversight.

Why It Worked: The board did more than just add tech experts. It prioritised specific competencies (cloud economics, AI ethics, SaaS scaling) that mirrored Nadella’s “mobile-first, cloud-first” vision. This alignment enabled faster, more informed decisions on acquisitions (LinkedIn, GitHub) and R&D pivots.

Static boards can potentially derail and destabilise the growth trajectories of even the best companies. When boards evolve with the company’s competitive context, they truly become strategic multipliers. Dynamic boards ensure that governance capabilities are in synch with changing circumstances and objectives.

2. Diversify beyond conventional parameters

While gender and ethnic diversity remain important considerations, truly effective boards encompass broader dimensions of diversity that include cognitive styles, functional expertise, industry experience, and career trajectories.

This multidimensional diversity fosters richer strategic dialogues and more robust decision-making processes.

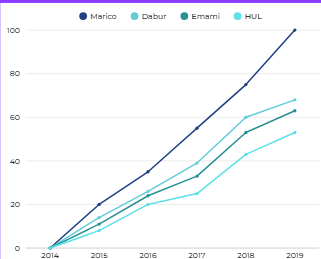

The reconstruction of Marico’s board provides a compelling example.

Marico outpaced peers like Dabur, Emami, and HUL in shareholder returns post their board transformation.

When Chairman Harsh Mariwala began transforming the company’s governance structure in 2014, he deliberately sought directors with varied functional backgrounds.

Notable additions included Saugata Gupta (CEO, Marketing), Noshir Kaka (digital and technology, ex-McKinsey), and Amit Chandra (global finance, Bain Capital).

This diversity of thought enabled Marico to enter new categories and geographies more successfully than many competitors, resulting in a revenue CAGR of approximately 9.3% over the subsequent five years.

3. Ensure Cultural Compatibility with Strategic Autonomy

The most effective boards achieve a delicate balance between cultural alignment and intellectual independence. They ensure that directors share the company’s core values while also maintaining the autonomy to challenge assumptions and conventional thinking.

When Bharti Airtel restructured its board in 2017, it carefully selected directors who understood the company’s entrepreneurial culture while also bringing in external perspectives.

Notable appointments included telecom veteran Craig Ehrlich (regulatory expert), Dinesh Kumar Mittal (FMCG and digital leader), Nisaba Godrej (business leader), and internal leaders like Harjeet Kohli and Rakesh Bharti Mittal.

This reconstructed board preceded Airtel’s successful navigation of the Jio disruption and its subsequent pivot to digital solutions, demonstrating how cultural compatibility combined with strategic autonomy can drive resilience and innovation.

The five-step ABC Way to architect strategic multiplier boards

A weather-proof board that also evolves with circumstances and ambitions.

1. Define Board Purpose Beyond Compliance

The first step is to understand what the board should accomplish beyond regulatory compliance. Is it to accelerate international expansion? Drive digital transformation? Enhance operational excellence? Or navigate regulatory complexities? This clarity of purpose guides our recommendations about board composition and operation.

When Blackstone acquired Mphasis, they clearly defined its purpose: to transform Mphasis from a mid-tier IT services provider into a digital transformation leader. This clarity guided the selection of directors with deep expertise in digital innovation and global market access.

2. Audit Skills Strategically

Once the board’s purpose is defined, the next step is to map the company’s three-year strategic priorities against potential directors’ capabilities. This reveals critical gaps that targeted recruitment can bridge.

When Aditya Birla Capital reconstituted its board in 2020, it began with a comprehensive skills audit mapped against its fintech ambitions. This led to the appointment of directors and executives such as Suresh Mahalingam (digital insurance), Rakesh Singh (digital lending), and T. S. Vishwanath (regulatory and digital policy), as well as the elevation of leaders like Ajay Srinivasan and Vishakha Mulye, both with strong digital transformation credentials.

The company reported robust double-digit growth in digital transaction volumes, with digital channels accounting for most of the new business in key segments within 18 months.

3. Cultivate Effectiveness

The third step involves determining the optimal board size, committee structure, and meeting cadence based on the company’s strategic complexity and growth stage. This should facilitate both efficiency and effectiveness in governance processes.

Research by the National Stock Exchange (NSE) Centre for Excellence in Corporate Governance (2023) found that Mid-sized Indian companies (₹500-2,000 crore revenue) typically perform best with boards of 8-10 members, while larger companies with revenues exceeding ₹5,000 crore often benefit from boards of 10-12 members with specialized committees.

4. Rigorous Selection Discipline

With the board’s purpose, required skills, and processes defined, the focus shifts to implementing a comprehensive competency-based selection process. This emphasises complementary skills, cognitive diversity, and strategic alignment rather than merely prestigious backgrounds or personal connections.

5. Establish Evaluation Pitstops

The final step is to take strategic pauses to assess board effectiveness, focusing on contribution, not just procedural compliance.

On one hand, these evaluations look at past contributions; they are also future-sensitive. They assess the board’s ability to anticipate and address emerging challenges.

This five-step blueprint is a common-sensical approach to getting your board to multiply your efforts, but it is not easy. Having a sounding board to sherpa you through the process helps.